Articles de blog de Lachlan Snoddy

In at the moment's quick-paced monetary landscape, many individuals discover themselves in need of fast money for unexpected bills or pressing monetary obligations. One choice that often surfaces in such conditions is the no credit examine loan. This text delves into the basics of no credit score test loans, their benefits and drawbacks, and essential issues to keep in mind before opting for one.

What's a No Credit Examine Loan?

A no credit score verify loan is a sort of borrowing that does not require the lender to evaluate the borrower's credit score history or rating as part of the approval course of. These loans will be particularly appealing to people with poor credit score histories or those who have not established credit score yet. As a substitute of counting on credit score scores, lenders may use different methods to evaluate the borrower's skill to repay the loan, reminiscent of earnings verification, employment status, and banking historical past.

Varieties of No Credit score Check Loans

No credit score examine loans are available in numerous forms, every tailor-made to satisfy different financial wants. Listed below are some common types:

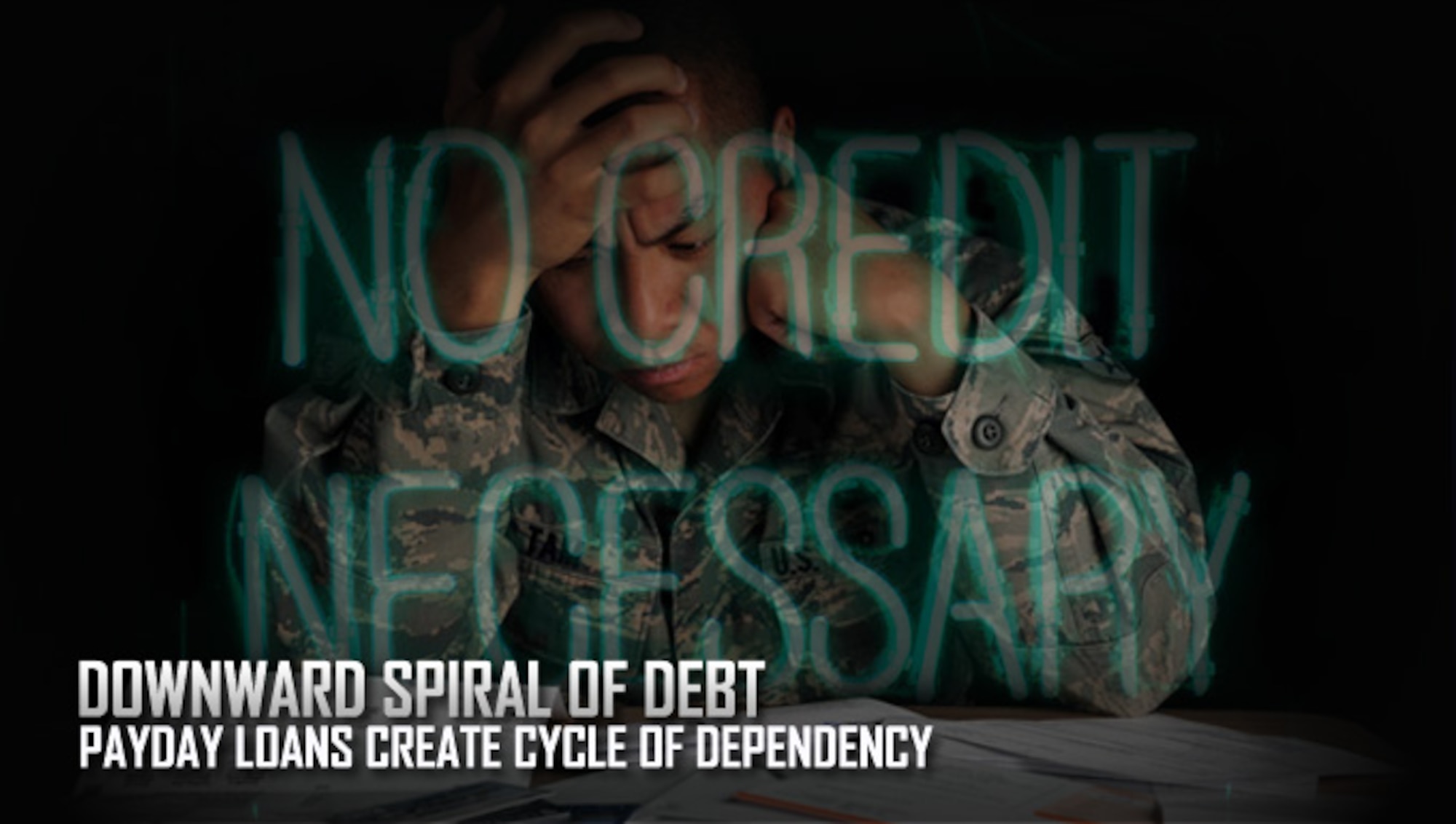

- Payday Loans: These are brief-time period loans sometimes due on the borrower's next payday. They are often used to cover emergency bills however can come with high-interest rates and charges.

Benefits of No Credit Test Loans

- Accessibility: The primary advantage of no credit score test loans is their accessibility. Individuals with poor credit or no credit history can nonetheless obtain financing after they need it most.

Drawbacks of No Credit Test Loans

- High-Curiosity Rates: One of many most significant downsides to no credit score examine loans is the excessive-interest charges associated with them. Lenders typically cost exorbitant fees to compensate for the elevated danger of lending to people with poor credit score.

Vital Issues Earlier than Making use of

Earlier than applying for a no credit check mortgage, it is crucial to contemplate the following factors:

- Perceive the Terms: Fastidiously learn the mortgage agreement, together with interest rates, charges, and repayment phrases. Make sure you absolutely perceive the full quantity you will owe by the end of the loan term.

Conclusion

No credit test loans can present a lifeline for people in want of fast money, especially those with less-than-perfect credit histories. However, it's crucial to method these loans with caution, as they usually include high-curiosity rates and brief repayment phrases. By understanding the forms of no credit check loans available, their advantages and drawbacks, and the components to think about earlier than making use of, borrowers can make knowledgeable decisions that align with their financial wants and objectives. Always remember to prioritize responsible borrowing and explore all choices earlier than committing to a loan.

Ultimately, whereas no credit score verify loans can supply speedy relief, they must be considered as a temporary answer somewhat than a long-term financial strategy. Accountable financial planning and exploring different choices can lead to better outcomes and higher financial stability in the long run.